Some thoughts on Celsius ($CELH)

FWIW, my 5 favorite flavors in the skinny cans are Orange, Tropical Vibe, Mango Passionfruit (not pictured), Strawberry Lemonade (not pictured) and then for 5th place it’s either Watermelon, Peach Vibe or Arctic Vibe.

There’s also a nice Black Friday sale going on at Vitamin Shoppe [link] where you can save 25% on Celsius orders (over $65) plus free shipping. I already bought 8 cases over the past couple days. Use the code “RareDeal” [click here].

CELH — Celsius

Q3 earnings report [click here]

CELH had a wild week and since I’m getting lots of questions from friends, subscribers and strangers about the price action I’ll try to summarize my thoughts on the situation. Let me preface this by saying that I don’t have any inside information and have not spoken to anyone from Celsius in 2+ weeks, which was their IR person, and when I did ask him about a possible acquisition by Pepsi he said “I can’t comment on that” which means all of the thoughts you’re about to read are mine alone or those of my friends and fellow shareholders whom I speak to regularly.

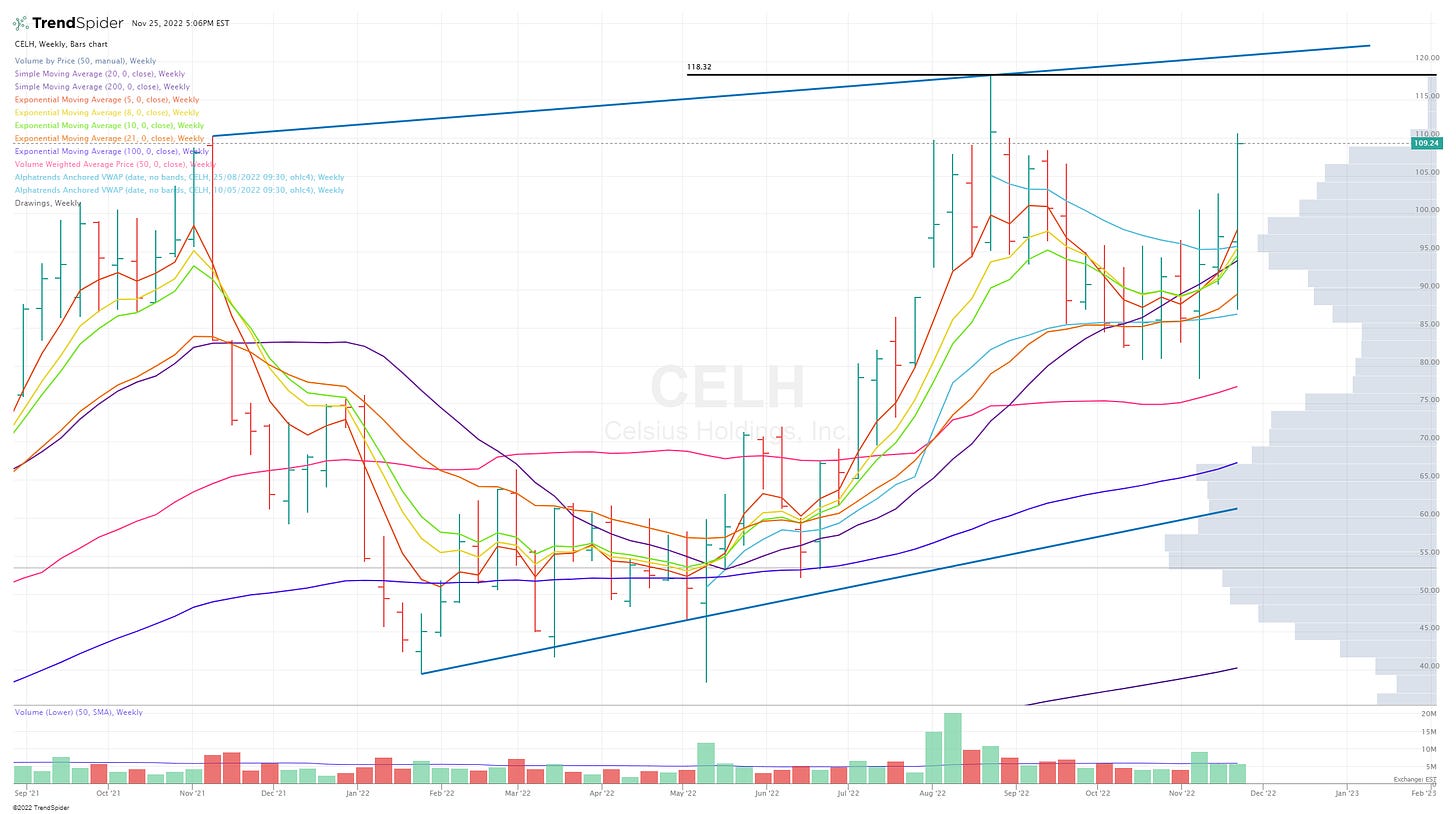

CELH was down 9% on Tuesday morning with no significant news so I added to my position as it bounced off the 100d EMA. I still have no idea why the stock pulled back below $88 (perhaps some selling from Carl DeSantis, the largest shareholder) but it turned out to be an incredible buying opportunity because CELH is up 25% from the Tuesday lows, touched $110 today and had it’s highest close since late August. With this wild price action the past two days I have to wonder if something is going on with Pepsi — perhaps speculation they might look to acquire CELH sooner rather than later. I have no inside information but this is a pretty big move after the strange dip on Tuesday.

TBH I’m not sure if Pepsi is even allowed to add to their position in the open market, but if they can, some of this buying could be them trying to increase their stake. It could also be a fund or funds building a position in CELH for a variety of reasons.

Here’s why I’m doing this mini writeup on a Friday afternoon when I should be at Best Buy or Target looking for the best Black Friday deals (just kidding)… over the past couple days a bunch of people have emailed me and/or DM’d me asking for my thoughts on the price action in CELH stock and whether Pepsi might try to buy them before year end.

Personally I’d be a little surprised if Pepsi ($PEP) was ready to acquire CELH this quickly after doing their distribution deal a couple of months ago however it’s possible the integration is going so well and feedback from retailers is so strong that PEP realizes it would be smarter to buy CELH now for $135-140 per share rather than wait a couple years and pay $200+ per share.

I came up with $135-140 per share because it’s a 50% premium to the 50-day VWAP which is the same VWAP they used with Pepsi when they did the $550M investment for 8.5% of the company a couple months ago. I’d be surprised if CELH management would sell the company for any less than $135-140 because they’re still growing triple digits, expanding margins, adding more retailers/stores/coolers and now have BANG on life support which means CELH is now #3 in the energy/fitness drink category.

If Pepsi crushes it with Celsius and takes their store count from 175k to 600k+ over the next couple years as well as driving international expansion into Canada, Mexico, Europe, Australia, etc then it’s just going to pump up the purchase price for Pepsi in the future. Maybe the Pepsi execs realize this and would rather get the deal done.

Pepsi has a market cap of $260 billion and will do $85 billion of revenues this year but they’re only growing those revenues at 6-7% with analysts expecting 3-5% annual growth going forward. PEP needs to buy growth and CELH is one way to do it. CELH is not a cheap stock with a market cap of $8 billion however they grew revenues 140% last year and they’re on track to grow revenues 110% this year. Revenues at CELH are up 9x from just 3 years ago.

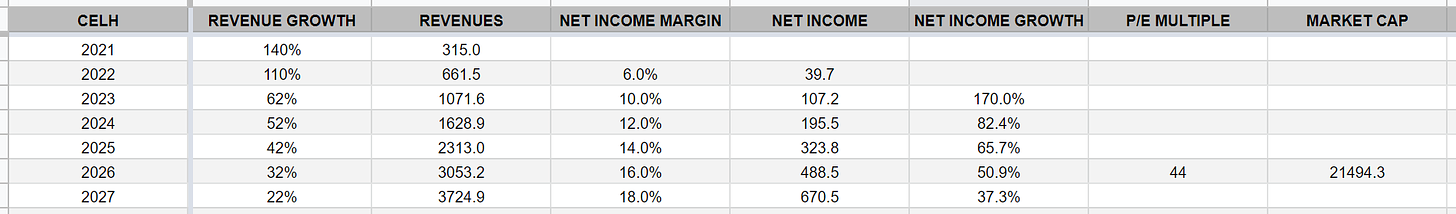

Here are my CELH revenue forecasts for the next 5 years:

2022: $662M (110% YoY growth)

2023: $1071M (62% YoY growth)

2024: $1628M (52% YoY growth)

2025: $2313M (42% YoY growth)

2026: $3052M (32% YoY growth)

2027: $3725M (22% YoY growth)

In addition to this revenue growth I think CELH will continue to expand net income margins (NIMs) from 6% in 2022 to 18% in 2027, aided by their distribution partnership with PEP and everything that PEP brings to the table in terms of distribution (more cooler space) sales & marketing, procurement, logistics, etc. — without PEP then I think CELH could have gotten NIMs to 14% by 2027 which means the PEP partnership is worth at least 1% improvement to NIMs per year.

CELH has been able to increase revenues by 9x over the past 3 years without a distribution partner like PEP, they had been using Anheuser Busch most recently but it was dozens of regional companies versus a global monster like Pepsi. Working with Pepsi will streamline everything for CELH which will also lead to cost savings across the board. This is why I think NIMs will expand faster than previous expectations. MNST has NIMs of 22-27% depending on the year — their NIMs also took a dip during the pandemic because they also ran into higher freight/can costs which hit their margins just like it did for CELH. I don’t think CELH can get NIMs to 25% in the next few years which is fine if they’re able to keep growing 5x faster than MNST. Based on my CELH estimates and the current MNST estimates (from analysts), CELH will increase revenues by 869% from the end of 2021 through 2026 versus MNST increasing revenues by 59% during the same time period. This is why comparing the CELH multiple (P/S, P/E, EV/GP or EV/EBITDA) to the MNST multiple makes almost no sense. This would be like comparing the TSLA (Tesla) multiple in 2019 to Ford (F) or General Motors (GM) during that same time. TSLA was growing 10x faster than the other car companies so comparing multiples is a pointless exercise.

But we’re going to do it anyways…. right now MNST EV (enterprise value) is $51.6B with $6.4B of revenues and $1.68B of EBITDA versus CELH EV of $7.9B with $662M of revenues and $82M of EBITDA. Using these numbers…

MNST is trading at 8.1x revs and 30.7x EBITDA with 15% growth in 2022 (est) and 11% growth in 2023 (est)

CELH is trading at 11.9x revs and 96.3x EBITDA with 110% growth in 2022 (est) and 62% growth in 2023 (est)

So yes, CELH is trading at a higher multiple but they’re also growing 6-7x faster than MNST not to mention CELH has much more room for margin expansion over the next few years than MNST so while MNST is growing EPS at 20-30%, CELH is growing EPS at 100-200%.

Just in case you weren’t paying attention to CELH Q3 earnings, they reported a surprise loss but that’s only because they had to pay $155.4M of termination fees (plus another $50M+ in Q4) to their prior distribution partners but they also disclosed that Pepsi is reimbursing them for all of these fees over the life of their 20-year distribution agreement.

CELH has been able to increase revenues by 9x over the past 3 years with very little contribution from international — these sales have actually been declining the past year so it’s been a drag on fundamentals. This is going to change with Pepsi because they have distribution everywhere and the Pepsi executive [Jim Lee, bio] that joined the CELH board after they invested $550M spent most of his career running international sales/strategy for Pepsi in Europe, Russia, Asia and Australia — it’s pretty clear these regions will be a focus for CELH and PEP as they join forces to take on Monster and Red Bull across the globe.

Speaking of competition, BANG has fallen off the map since losing Pepsi as their primary distributor and they’ve already pissed off every other beverage distributor so it’s going to be hard for them to rebuild their DSD (direct store delivery) business. Personally I think the only hope for BANG is being acquired for pennies on the dollar by Keurig Dr. Pepper ($KDP) but BANG is still on the hook for $550M of damages from the recent court battle loss against Monster ($MNST) and no buyer wants to overpay for BANG and then have to pay $550M to Monster plus ongoing royalties. Knowing this, there’s also a remote chance that Monster could buy Bang for $200M or less, forgive the $550M legal payment and then distribute BANG through Coca-Cola ($KO) which is their primary distributor.

I was on Cape Cod the past few days visiting my family and the local gym finally started carrying Celsius. I talked to the co-owner and she told me that Celsius is selling so well they stopped carrying BANG and AlaniNu because they wanted to free up space for additional Celsius flavors. I told her to get some orange and tropical vibe!!

As I mentioned at the top, I added to my CELH position on Tuesday morning when it bounced off the 100d EMA (I posted this buying opportunity in my Stocktwits room) but then we got a clear breakout on Wednesday with some impressive follow-through buying today. If I didn’t already own CELH then I might start a 1/4 position next week but please don’t chase it. FOMO is not a good strategy even when the fundamentals are strong like they are with CELH.

It’s probably smarter to wait for the next pullback (assuming we get one) with the 10d EMA at $98.40 and 21d EMA at $94.70 — personally I’ll probably add at both those levels because I remain very bullish on CELH for the next few years which means most pullbacks are a buying opportunity for me and other long term investors.

As you can see from the price by volume area on the right, CELH is now above the last big volume shelf which means very little resistance above from current shareholders looking to get out at breakeven. That’s usually how I interpret it. Of course you’re always going to get some profit taking at ATHs but overall it’s bullish for the stock when you clear all the volume shelfs.

Even though CELH rallied 25% the past couple days off the Tuesday lows I didn’t trim my position. My next trim would not be until $118 and that’s only if the stock got rejected at that price (prior ATH). If the stock pushed through then I’d keep my full position and only trim if that new support level was broken. As you can see from this weekly chart below, CELH could run into resistance at $118 (ATH) but then it might run into resistance at the line connecting the 2021 high to the 2022 high which would probably be around $120 plus I think that’s a psychological resistance level where some investors will look to trim their position. I would not be surprised if CELH keeps rallying to $118-120 then pulls back and retests the 5/8/10d EMA before making a push through $120. Of course if Pepsi decides to acquire CELH then you can throw all this commentary out the window because as I suggested earlier, I think an acquisition offer from Pepsi would have to be in the $135-140 range which would put the deal just south of $12 billion (not including current cash or the preferred stock Pepsi got for their investment).

As if we needed another reason to like CELH, just look at their SBC (stock based compensation) which is tracking to be less than $20M in 2022 which is less than 3% of revenues. Now compare that to some of the tech/cloud/software companies that are giving out SBC like skittles to the tune of 30-50% of revenues. CELH continues to prove they can grow without being fiscally irresponsible like so many other growth companies ie DraftKings, Peloton, Coinbase, Robinhood, Snapchat, Twilio, Facebook, Shopify and the list goes on. Many of these “other” growth companies are laying off 20-30% of their workforce in order to right-size the company and get costs under control and better reflect the current state of their business. If a company is growing revenues at 20-30% they should not be growing headcount by 40-60%.

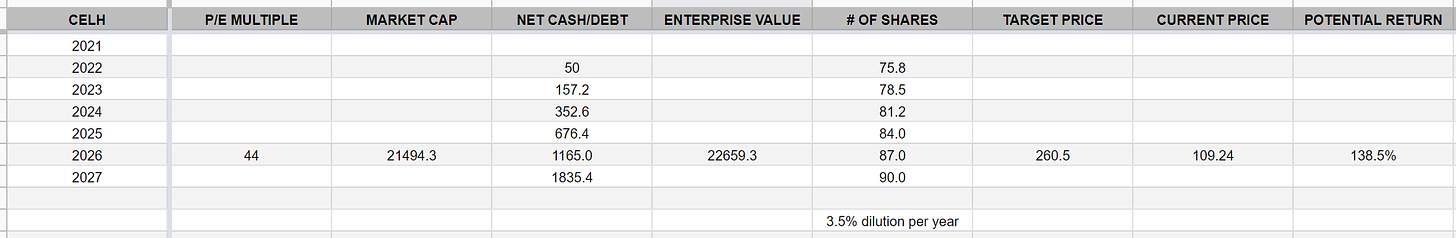

Here’s my updated investment model for CELH with my assumptions for revenue growth, net income margins and multiples as well as 3.5% annual dilution from SBC (even though it’s tracking lower this year).

This investment model does not include the shares that would be created if/when Pepsi converts their preferred stock but it also does not include their $550M investment which is still sitting on the CELH balance sheet and could be used for lots of things including small acquisitions to add new products to their portfolio. If they did make any acquisitions I assume PEP would need to approve it since CELH would probably use PEP for distribution. I doubt CELH would acquire any company that competed directly with PEP products. There are a few private companies that might made sense for CELH if they wanted to go deeper into fitness/functional drinks with a better BCAA drink or perhaps a recovery/hydration drink. I have a few in mind but I’m not going to speculate about them here. I have a good relationship with several people at CELH so after I find a new drink that I really like I typically report back to my CELH contacts with some feedback.

This mini-writeup just hit 2500 words so I’ll stop it there although I could keep going for another 2500 words — lots to talk about with CELH because it’s a company that continues to execute very well and surpass my highest expectations. As a shareholder it’s exciting when you find a company like this. Part of me hopes that Pepsi does not acquire CELH because I want to own this stock for the next 3-5 years and see where we can take it.

Have a great weekend everyone and don’t forget to watch my recent interview with the CEO of Shift4 ($FOUR).

Regards,

Jonah

Disclaimer: The stocks mentioned in this newsletter are not intended to be construed as buy recommendations and should not be interpreted as investment advice. Many of the stocks mentioned in my newsletter have smaller market capitalizations and therefore can be more volatile and should be considered more risky. I encourage everyone to do their own research and due diligence before buying any stocks mentioned in my newsletters. Please manage your portfolio and position sizes in accordance with your own risk tolerance and investment objectives.