Part 1: Deep dive on Mobileye ($MBLY)

In addition to my Substack newsletter, I also run a Stocktwits room where I post my current holdings, buys & sells, investment models, technical analysis and market commentary for both my Investment Portfolio (long term, strong fundamentals, 20-30 holdings) and my Trading Portfolio (short term, strong technicals, 0-10 holdings). The two options are $15/month for the monthly plan [click here] or $150/year for the annual plan [click here].

You can now signup for my new Substack called Jonah’s Trading Charts which is focused exclusively on the technicals — every day (usually pre-market) I’ll send out an email with my favorite trading charts/setups. You’ll also have access to my trading portfolio with current positions/sizes, entry/exit prices, profits/losses and much more. I’m also doing live charting and live trading 3-4 times per week.

Company: Mobileye

Ticker: (MBLY)

Website: Mobileye.com

IPO date: October 26, 2022

IPO price: $21.00

Current stock price: $30.04

Outstanding shares: 801.9 million

52 week high: $37.31 on December 14, 2022

52 week low: $24.85 on November 03, 2022

Market cap: $24.1 billion

Enterprise value: $23.3 billion

Headquarters: Jerusalem, Israel

Number of employees: 3,900+

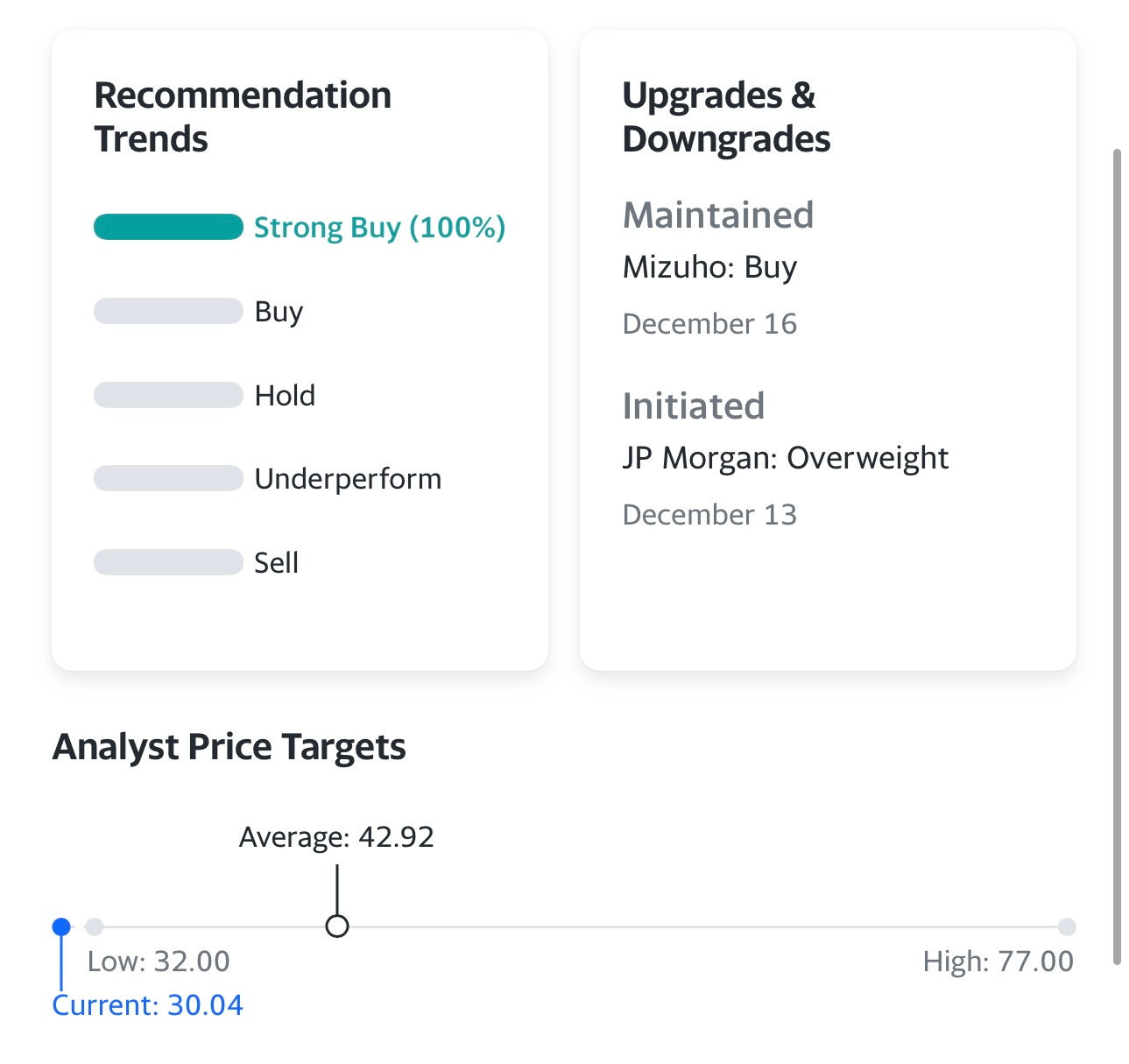

Average price target from analysts: $42.92

Investor Relations [click here]

Q3 2022 Earnings Report [click here]

CES 2022 [click here]

Outline

**Part 2 should be out in the next couple days

Introduction — will be in part 2

Company Background

Opportunity

Technology

Business Model

Customers

Competitive Advantages

Management

Culture

Financials

Risks

Ownership

Valuation — will be in part 2

Investment Model — will be in part 2

Analysts — will be in part 2

Technicals — will be in part 2

Conclusion — will be in part 2

Company Background

Mobileye was founded back in 1999 in Jerusalem, Israel, by professor Amnon Shashua (in the photo on the left), who still runs the company to this date, together with Ziv Aviram (in the photo on the right) and Norio Ichihashi.

Mobileye began as Shashua's academic research at the Hebrew University of Jerusalem, where he was an associate professor of engineering and computer science. His research later evolved into a vision system designed to work on a computer chip that could detect vehicles using a camera and special software.

Shashua was one of the first to say that computer vision technology could help prevent automobile crashes and save people's lives. Later, a multi-billion industry emerged from this idea, and Mobileye became one of the leading players in this industry.

Although the first advanced driving-assistance system (ADAS) was used in the 1950s (an anti-lock braking system), some call Shashua a grandfather of modern ADAS (based on cameras). It all began in 2004 when Mobileye introduced the industry's first-ever camera-based ADAS. It was a single monocular camera that was later combined with computer vision software that let the vehicle see and interpret the environment, similar to how humans do.

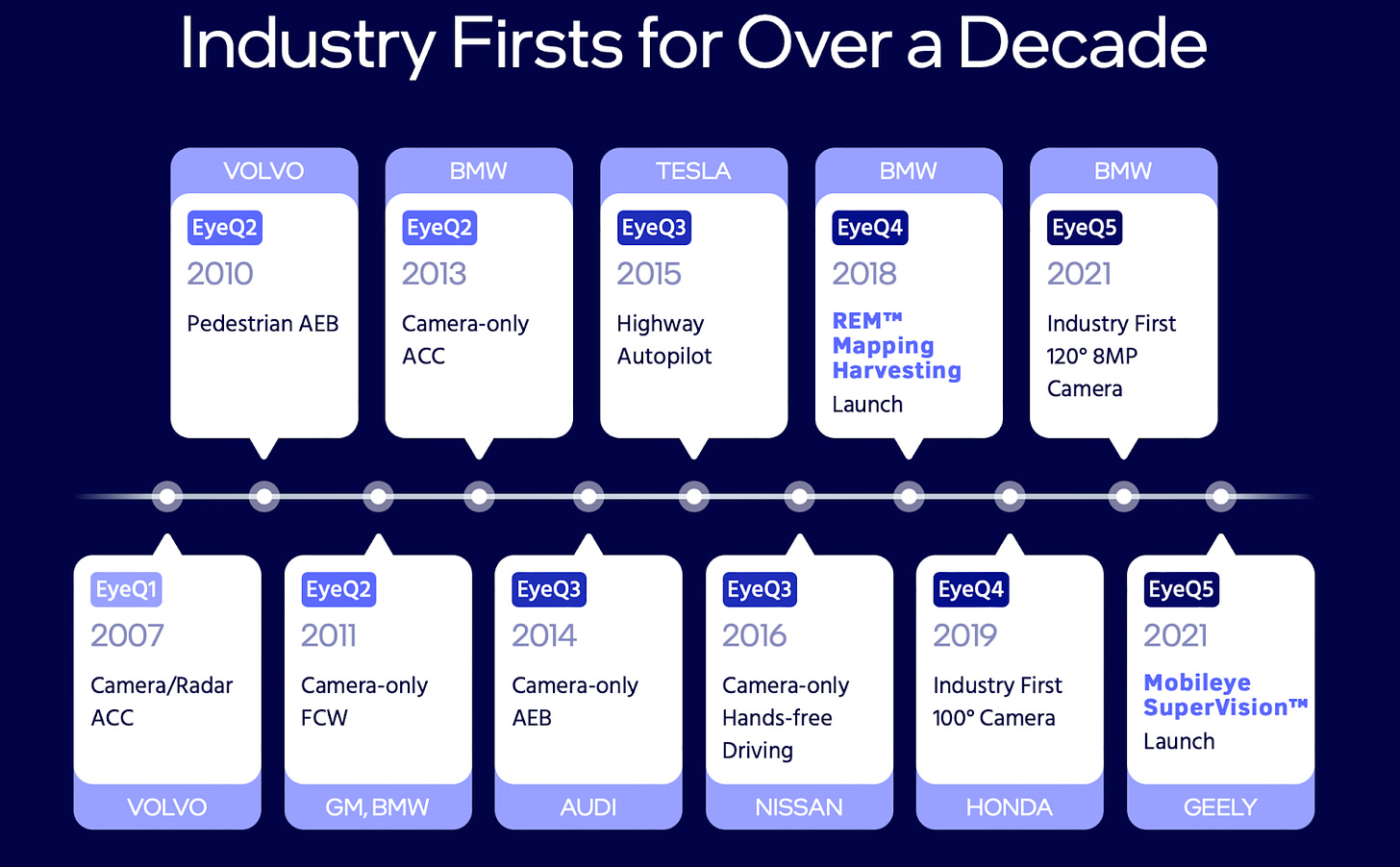

After three years of engineering and testing, Mobileye launched its first-ever commercial product, EyeQ1 System-on-Chip (SoC), providing an automatic emergency braking (AEB) feature. BMW was the first commercial customer to install Mobileye's chip in its vehicle, the fifth-generation BMW 7 Series.

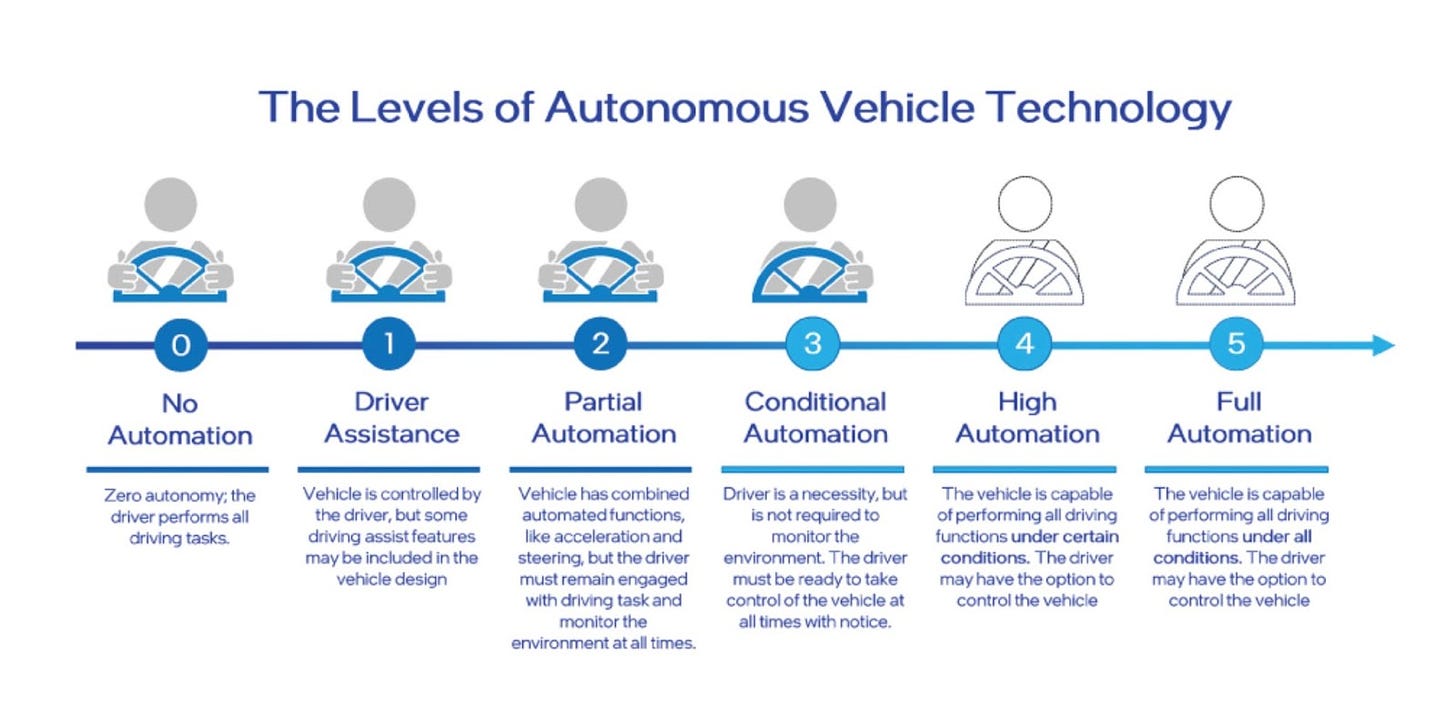

The EyeQ1 chip was aimed at Autonomous Level 1 (Driver Assistance), at which the driver controls the vehicle, but some driving assistant features are included in the vehicle design to make driving safer.

Today, as defined by The Society of Automotive Engineers (SAE), there are five levels of ADAS / autonomous driving. Basic driver assist features, such as automatic emergency braking, lane-keeping assistance, and adaptive cruise control, fall into the category known as SAE Level 1 and 2. On these levels, the driver must remain engaged at all times. For a long time, ADAS of Levels 1 and 2 were the only ones allowed for road use.

The major breakthrough came in recent years with the development and regulation (the first binding international regulation on Level 3 vehicle automation was introduced in June 2020) of Level 3, which refers to premium driver assist functions that allow the driver to perform hands-free driving but still require monitoring the driving and being ready to take control at any time with notice (e.g., Tesla Autopilot).

Level 3 is the critical category, as it will enable the path to full autonomy at scale, starting from hands-free highway driving to gradually extending to other types of roadways, such as rural, urban, and arterial roads, before reaching Level 4 (at which robotaxis and autonomous delivery vehicles will be able to operate without a driver but with minimal involvement of a teleoperator) and eventually Level 5 (where no human driver intervention will be needed in any situation at all).

While it is still a long way toward the mass adoption of at least Level 3, Mobileye undoubtedly will play a critical role in accelerating this adoption. The company has constantly been innovating and introducing multiple industry-first ADAS products, including Level 3 Highway Autopilot (back in 2015) and, most recently, Mobileye SuperVision (launched in 2021), the most advanced driver-assist system on the market, providing “hands-off” navigation capabilities of an autonomous vehicle and designed to handle standard driving functions on all regular road types.

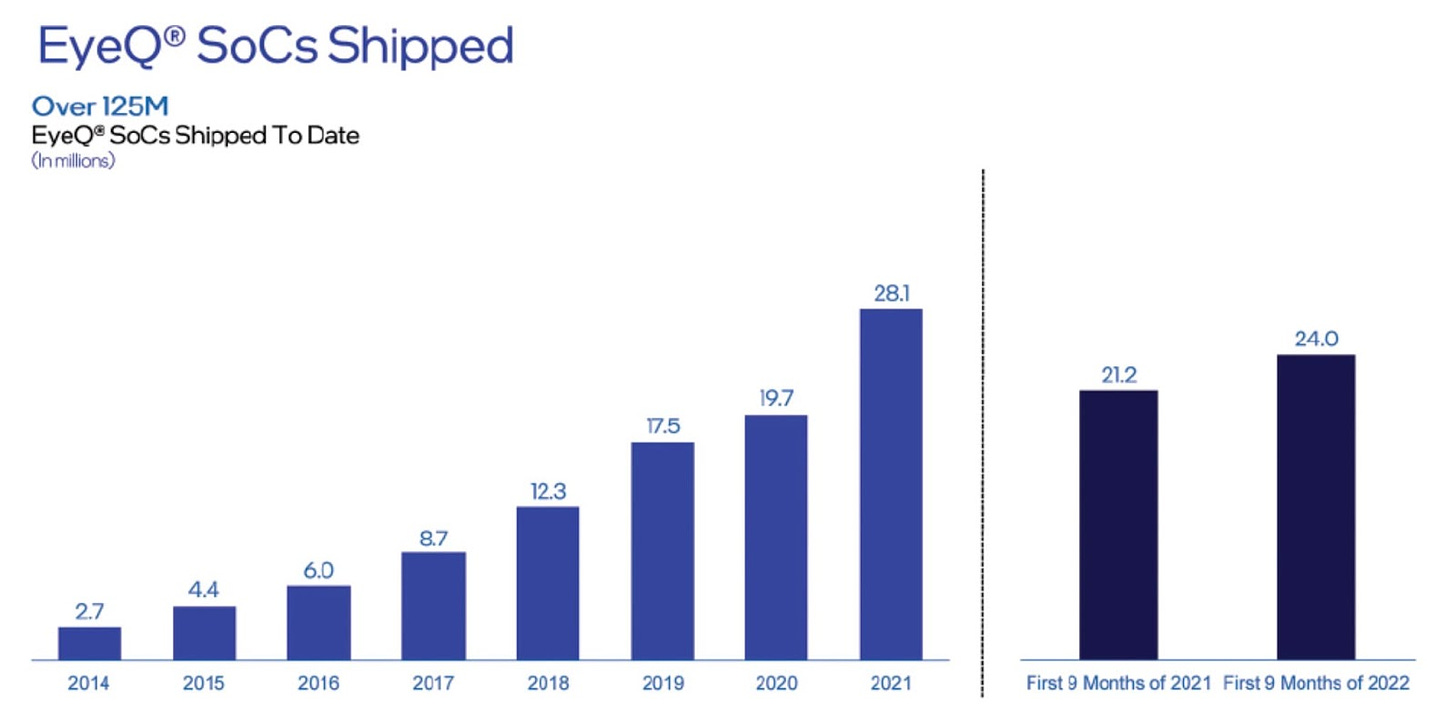

Cumulatively, since 2007, Mobileye's various ADAS technologies have been installed in approximately 800 vehicle models of more than 50 automakers. EyeQ SoCs have been deployed in more than 125 million vehicles, making Mobileye the most successful commercial company in the space.

This success was partially possible due to timely investments in the company to support ongoing innovation. Prior to going public in 2014, Mobileye had raised over $500 million in private rounds from the likes of Goldman Sachs and Morgan Stanley. In its first IPO, the company raised almost $900 million at a $5.3 billion valuation before it was acquired by Intel in 2017 for $15.3 billion.

The Intel acquisition was a pivotal moment for Mobileye. With the help of Intel, the company was able to accelerate the development of important new technologies, such as REM (crowd-sourcing map data sourced globally) and Mobileye SuperVision (mentioned earlier).

Another significant achievement was the development of software development kits that helped facilitate better design-in with the automotive customers, which in turn helped Mobileye to win more customers.

As a result, Mobileye's revenues have quadrupled since Intel bought the company in August 2017, generating about $1.4 billion in sales in 2021. Mobileye became one of the fastest-growing businesses within Intel.

“I supported the sale of Mobileye to Intel in 2017 to accelerate Mobileye’s transition from a world leader in driver assistance systems to a leading enabler in the evolution to autonomous driving solutions. Together we accomplished that goal.” – Amnon Shashua, the co-founder and CEO of Mobileye, in the 2022 Shareholder letter.

However, in the summer of 2022, the separation from the parent company Intel began, and on October 26, 2022, Mobileye became public for the second time. Initially pricing shares at the range between $18 and $20 per share, Mobileye began trading at $21 per share before rising to $28-30 in the first week of trading.

Intel sold 41 million shares, representing a tiny percentage (~5%) of its total holding. Mobileye raised $861 million in this offering at approximately $17 billion valuation, just $1.7 billion more than Intel paid for the company in 2017.

It is still unclear why Intel decided to spin off Mobileye and do it now, at the worst time for IPOs. After all, the chip giant valued Mobileye at $50 billion at the beginning of 2022.

“We intend to use a portion of the net proceeds that we receive from this offering to repay [an as-yet undisclosed amount] of indebtedness under the Dividend Note [to Intel] and use the remaining [proceeds] for working capital and general corporate purposes.” – from Mobileye's statement.

Whether Intel needed to offload Mobileye to fund its dividend payments and help save its sinking stock, Mobileye, which is at the forefront of automated-driving technology (one of the hottest industries right now), would have undoubtedly attracted plenty of interest from public investors, even at these times on public markets, and provide Intel with enough liquidity.

Regardless of the real intentions, Mobileye remains at the very early stage of its growth story. It has produced increased topline revenue in recent years, with expanding gross margins, manageable operating losses, and positive cash flow from operations (though fluctuating).

Mobileye is one of those rare growth companies that already generate cash by selling products widely used today while building the next-generation products that will be used at an even grander scale in the near future.